ANALYZING INDIA’S ECONOMY-2017-18

ANALYZING INDIA’S ECONOMY-2017-18

Prof. Ashok K. Sinha (Chief Editor-4DIJMS.New Delhi, India )

Prof. Nisha Singh (Chair Person-Business, Livingstone College, NC,USA )

INDIA – Amongst the three Fastest Developing Economy

2017 -2018 have been the best period of four years in Indian Economy-Surjeet Bhalla, a member of the Prime Minister Advisory Council stated that according to the various economic development, India show a good economic performance .’ If you see from any analysis of a developing economy, you will find that the past four years have been the best years of Indian Economy. There is no doubt in the aforesaid fact”’-( Surjeet Bhalla ,Economic Advisor, Govt. Of India )

India is one the three fastest developing countries;

The Chief of IMF Kristine Leggard said ”As a consequence of different reforms, Indian economy is on the path of progressive development and that India is one of the three fastest developing countries”. Thus it can be concluded that this development will continue in the same way in the future too, Further it was observed that the Indian Government has taken a decisive and courageous steps in the form of GST and its positive impact will be felt in the coming time.

Burden of Debts

The burden of debt on the country as compared with the best economical standards is less:only a day before the statement of Kristine Leggard,Director of government treasury matters of IMF ,Vitor Gasper ,said that in the world’s cheap and developing economy comparatively, burden of debt is less in india. According to the latest figures of IMF in 2017 India’s private loan was under GDP ,54.5 percent ,whereas ,GDP government debt was 70.4 percent.

The total loan of GDP was 123%and at the same time China’s GDP government debt is 247%. Gasper said that as such, the debt on India is very low on global GDP. He disclosed that India’s loan is less than average of a developed economy and average of a developing economy.

India’s economy will reach 7.5%of development ratio in the next 2 years:

The World Bank stated that India’s development rate may, by the end of the present financial year ,reach 7.3% and in the next two years 7.5 %. The World Bank in its report on Asia stated that ,’It seems the temporary deadlock in economy” After Demonetization and GST , the deadlock is now coming to an end.Tthe World Bank also mentioned in its report that economy in 2017-18 attained 6.7% development ratio including its fast recovery. The report also states that the implementation of GST and re-capitalization of banks is strengthening India’s development and has all possibilities of its gaining speed in the same. economic increment ratio, likely to be more than 7.4%

According to Reserve Bank of India ,in spite of rising crude oil costs and struggling international trade ,it is speculated that the development rate will be 7.4 %.Indian reserve bank has said that despite international hazards, in 2018-19 ,it will probably remain at 7.4% in the context of domestic production. Secretary ,Economic Affairs ,Subhash Chandra Garg ,anyhow ,said “It is expected that in the current financial year ,economic development will be more than 7.4 %”. It means in all possibility the development rate will be more than the Council’s expected rate.

“There is a positive relation between the debt to GDP ratio and the level of GDP per capita. If you compare around the world with the best economies or emerging market economies, the level of debt in India is lower,”( IMF) The IMF is stating that the Global Debt at $182 trillion in the year 2017 is all time record high . “Debt in advanced economies, since the global financial crisis, has increased quite substantially while the private sector has been very gradually leveraging.”.

“If you look at emerging market economies, that includes India, you see that private debt in the last 10 years has increased quite substantially, although in the last two years, since the end of 2015, 2016 and 2017, there is a slowdown in the process of leveraging, but debt is very high and public debt is a very high as well,” Gasper said.

In the last few years in India private debt has declined from almost 60 per cent to 54.5. “So, it’s very stable. So, what you do see is that emerging market economies, which is where India is, there’s a very fast buildup in private debt with a slowdown in the last two years, But India is basically steady. So, India is not an emerging market economy where leveraging is progressing fast,” Gasper

According to Gasper, in emerging market economies private debt has risen much faster than public debt. “Take China, for example. Total debt is 247 per cent of the GDP. But the dividing line between what is public and private debt in China is blurry. This blurriness reflects the very large number of public units and corporations, the complex layers of government, and widespread sub-national off-budget borrowing,” he said.

The World Bank Report

The Indian economy is likely to come back to its usual trend growth rate of 7.5 percent in the coming years. It is so estimated because of recovery from the impact of demonetization and GST . A new World Bank report says.”India’s growth in recent years has been supported by prudent macroeconomic policy: a new inflation targeting framework, energy subsidy reforms, fiscal consolidation, higher quality of public expenditure and a stable balance of payment situation.” In addition, it can be said that the recent policy reforms have helped India to improve the business environment, ease inflows of foreign direct investment (FDI) and improve credit behavior.

RBI Indian Consumer Survey

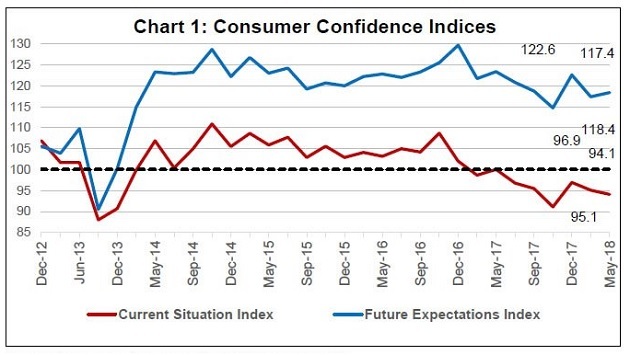

According to the latest survey conducted by the Reserve Bank Of India on Indian Consumers 48% consumers felt that the general economic situation had worsened from a year ago, while 31.9% said their economic situation had improved. The net response is -16.1 percentage points. However, in the June 2014 survey, the net response was -14.4, which was slightly better than now. But perception is low in 2017.(Table-1)-Eco.Times-RBI

CONCLUSION

After analyzing data and opinions of World Bank, IMF and RBI there is a valid positive sign of Economic development of India but the survey of RBI on Indian consumers gives a strong signal of the impact of economic development on Indian consumers. It needs special attention. The findings of the RBI consumer survey reveals that Micro or Macro economics are the areas which can impress or please the Economists, who can interpret, GDP, Inflation, Debt Ratio, NPA, and other economic tools for performance but consumers can not conceptualize these terms and ratios. They simply know their earnings , expenditures and availability of goods for purchase and utility. Their perception of Economy also takes cognizance of accessibility and convenience of availability. It is through the perception of consumers that the Government of any country can take political mileage, probably this could be the reason behind the RBI survey of Indian Consumers and needs consumer awareness and consumer satisfaction.

REFERENCES:

- https://economictimes.indiatimes.com/news/economy/finance/india-should-focus-on-womens-inclusion-in-economy-lagarde/articleshow/62618789.cms

- http://www.businessworld.in/article/India-s-Debt-Lower-Than-Best-Emerging-Market-Economies-IMF/10-10-2018-161909/

- https://www.worldbank.org/en/news/press-release/2018/03/14/india-growth-story-since-1990s-remarkably-stable-resilient

- https://economictimes.indiatimes.com/news/economy/indicators/rbi-survey-will-make-you-think-about-indian-economy-where-its-going/articleshow/64554315.cms

AUTHORS

Prof. Ashok K. Sinha (Chief Editor-4DIJMS.New Delhi, India )Prof. Nisha Singh (Chair-Person-Business, Livingstone College, NC,USA )Email :editor4dijms@yahoo.com